Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Algorithm-driven hedonic real estate pricing – An explainable AI approach

1

Faculty of Economic Sciences, University of Warsaw

2

Department of Management and Information Technology, Faculty of Economic Sciences, University of Warsaw, Poland

Submission date: 2024-05-22

Final revision date: 2024-09-18

Acceptance date: 2024-11-21

Publication date: 2025-03-14

Corresponding author

Bartłomiej Dessoulavy-Śliwiński

Department of Management and Information Technology, Faculty of Economic Sciences, University of Warsaw, Poland

Department of Management and Information Technology, Faculty of Economic Sciences, University of Warsaw, Poland

REMV; 2025;33(1):22-34

HIGHLIGHTS

- there is demand for fast and dependable support tools for real estate valuation

- the paper applies explainable ai to machine learning predictions in real estate

- building age, location and property area are most influential in our analysis

- shap framework reveals the model's understanding of interactions and nonlinearity

- the significance of data quality to ensure reliable model outputs is emphasized

KEYWORDS

residential real estatemachine learningexplainable artificial intelligencemass appraisalautomated valuation models

TOPICS

ABSTRACT

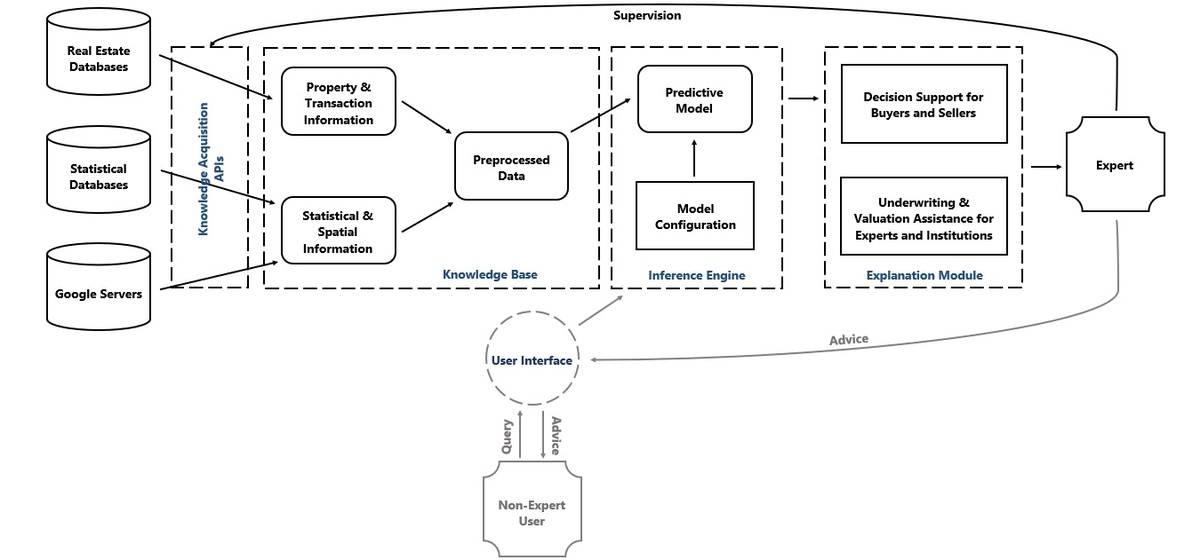

Data-driven machine learning algorithms triggered a fundamental change in hedonic real estate pricing. However, their adaptive nonparametric structure makes inference and out-of-sample prediction challenging. This study introduces an explainable approach to interpreting machine learning predictions, which has not been done before in the local market context. Specifically, Random Forest and Extreme Gradient Boosting models are developed for residential real estate price prediction in Warsaw in 2021 on 10,827 property transactions. Model-agnostic Explainable Artificial Intelligence (XAI) methods are then used to investigate the black box decision making. The results show the practicability of applying XAI frameworks in the real estate market context to decode the rationale behind data-driven algorithms. Information about the relationships between input variables is extracted in greater detail. Accurate, reliable and transparent real estate valuation support tools can offer substantial advantages to participants in the real estate market, including banks, insurers, pension and sovereign wealth funds, as well public authorities and private individuals.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.