Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Asset Pricing Puzzle: New Evidence of Fama-French Five-Factors in Emerging Market Perspectives.

1

Department of Finance & Banking, Jahangirnagar University, Bangladesh

Submission date: 2021-12-03

Final revision date: 2022-03-14

Acceptance date: 2022-05-05

Publication date: 2022-09-22

Corresponding author

REMV; 2022;30(3):73-86

HIGHLIGHTS

- the existing corporate finance literature does not provide us particular robust check if the Fama French five-factor model is equally exposed to estimate equity returns in an emerging market

- based on Fama and Macbeth (1973), Fama and French (1993, 2015), this paper applies multivariate regression (time series and cross-sectional) analysis for robust test of common risk factors and risk premia respectively in an emerging market context

- the study validates that all of the systematic risk factors are significant except firm profitability and investment strategy

- the finding could be important in estimating equity fair pricing that is yet to be examined particularly based on an emerging market

- the market practitioners, policy makers, financial analysts, and above all investors can estimate equity value appropriately, and thereby take an optimal financial and investment decision

KEYWORDS

TOPICS

ABSTRACT

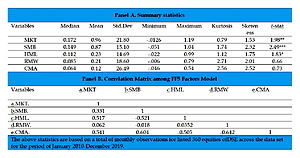

The asset pricing theory introduced by Fama and French (2015) documents five systematic common risk factors for equity valuation, such as: (a) market beta, (b) firm size, (c) firm value, (d) profitability and (e) investment strategy. However, corporate finance literature does not provide us with a particularly robust check if the FF5 model is equally exposed to estimate equity returns in an emerging market. Hence, based on Fama and Macbeth (1973) as well as Fama and French (1993, 2015, 2020), this paper applies multivariate regression (time series & cross-sectional) analysis for the robust test of common risk factors and risk premia respectively in an emerging market context, and finally validates that all of the systematic risk factors are significant except firm profitability and investment strategy. We found that the distinguishing semi-strong level of market efficiency influences the explanatory power of the underlying risk exposure for stock return performance differently in an emerging market. The finding could be important in estimating equity fair pricing that is yet to be examined for an emerging market. Therefore, with the reconfirmedthree significant common risk factors, the market practitioners, policy makers, financial analysts, and, above all, investors can estimate equity value appropriately, and thereby take optimal financial and investment decisions.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.