Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

COVID-19 impact to retail, hospitality, and offices spaces in Malaysia

1

Faculty of Built Environment and Surveying, Universiti Teknologi Malaysia, Malaysia

Submission date: 2023-03-19

Final revision date: 2023-10-28

Acceptance date: 2023-10-30

Publication date: 2024-03-06

REMV; 2024;32(1)

HIGHLIGHTS

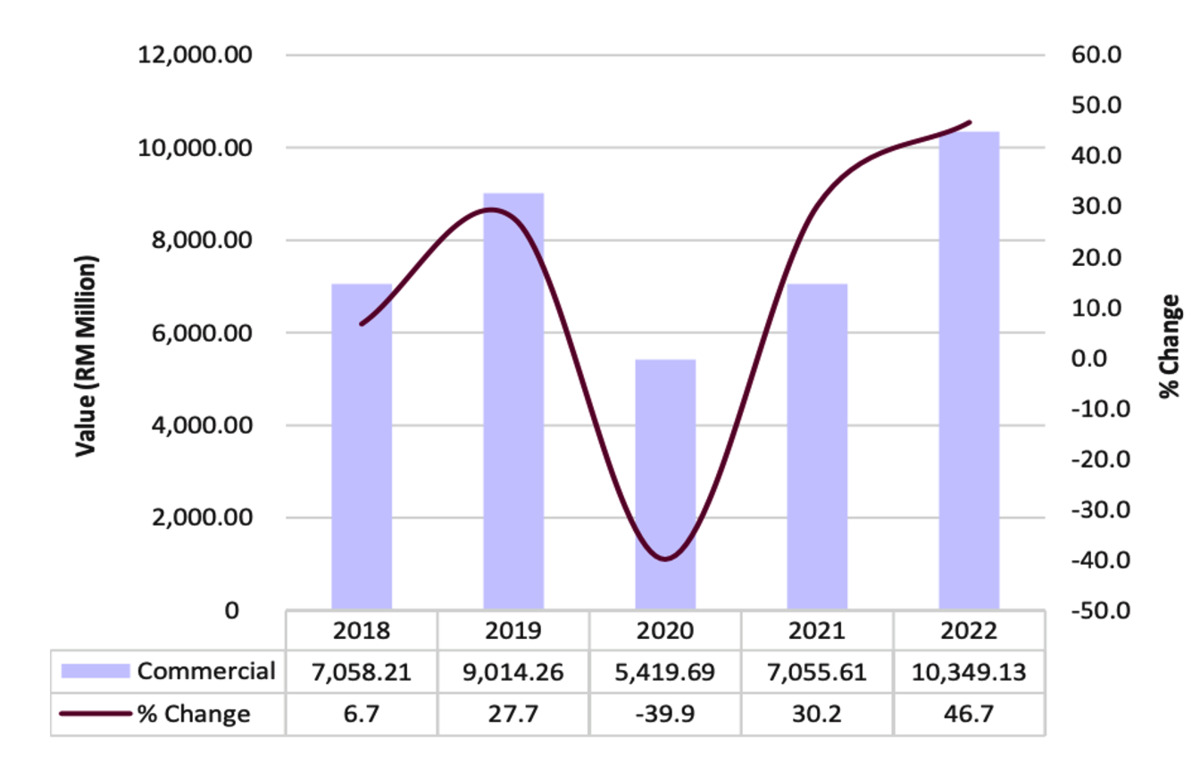

- article investigates effects of COVID-19 on commercial real estate prices in Malaysian market

- warnings listed for using direct real estate indices

- study combines data from direct and listed real estate to examine price variations by property types

- changes in key factors influencing commercial real estate pricing examined

- future trajectory of commercial real estate values covered in article

KEYWORDS

TOPICS

ABSTRACT

The COVID-19 pandemic has disrupted economies and industries worldwide, including the real estate sector. This study aims to assess the effects of the pandemic on commercial real estate prices in the Malaysian market. By examining variations in property types and considering key factors influencing pricing, the research contributes to a better understanding of the pandemic's impact on the real estate market. To analyze the effects of the COVID-19 pandemic on commercial real estate prices, a mixed-method approach was employed. The study combines data from direct real estate indices, which provide insights into property prices based on transaction data, and listed real estate, which includes publicly traded real estate investment trusts (REITs). By utilizing both sources, a comprehensive analysis of the market is achieved. The sample for this study consists of commercial real estate properties in the Malaysian market. It includes properties from various sectors, such as retail, hospitality, and office buildings. The sample is representative of the overall market and captures the different property types affected by the pandemic. The analysis begins by comparing direct real estate indices to highlight the limitations and potential biases associated with using these indices. It then examines the variations in commercial real estate prices during the COVID-19 outbreak, focusing on the different property types. Statistical techniques, such as regression analysis and trend analysis, are employed to identify patterns and quantify the impact on commercial real estate prices. The study's main findings reveal that the retail and hospitality sectors experienced the most significant impact on commercial real estate prices during the COVID-19 pandemic. These sectors witnessed a substantial decline in property values due to restrictions, lockdown measures, and reduced consumer demand. Office buildings, although moderately affected, also experienced some decline in prices. This research contributes to the existing literature on the effects of the COVID-19 pandemic on commercial real estate prices, specifically in the Malaysian market. By combining data from direct and listed real estate sources, the study provides a comprehensive understanding of the variations in property prices across different sectors. The findings offer valuable insights for real estate investors, policymakers, and industry professionals in adapting to the changing market conditions and making informed decisions regarding commercial real estate investments. In conclusion, this article sheds light on the effects of the COVID-19 pandemic on commercial real estate prices in the Malaysian market. The research methodology, which combines data from direct and listed real estate, allows for a comprehensive analysis of property variations among different sectors. The findings emphasize the significant impact on the retail and hospitality sectors, while showing office buildings to have been moderately affected. It also provides important insights for stakeholders in the real estate industry, enabling them to make informed decisions and develop appropriate strategies.

FUNDING

This research is funded by the Ministry of Higher Education under FRGS, Registration Proposal No: FRGS/1/2022/WAB02/UTM/02/1.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.