Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Econometric modeling of average housing prices in local markets and the price anchoring effect.

1

Uniwersytet Szczeciński

These authors had equal contribution to this work

Submission date: 2023-11-21

Final revision date: 2024-05-08

Acceptance date: 2024-05-15

Publication date: 2024-09-10

REMV; 2024;32(3):116-126

HIGHLIGHTS

- housing prices depend on anchoring quotas in the minds of both sellers and buyers

- the introduction of lagged prices into housing price models, in addition to traditional socio-economic variables, improves the quality of the models

- anchoring and adjustment heuristics are revealed not only in the actions of individuals, but also in the mass of individuals through which they affect the phenomena observed in the market

KEYWORDS

TOPICS

ABSTRACT

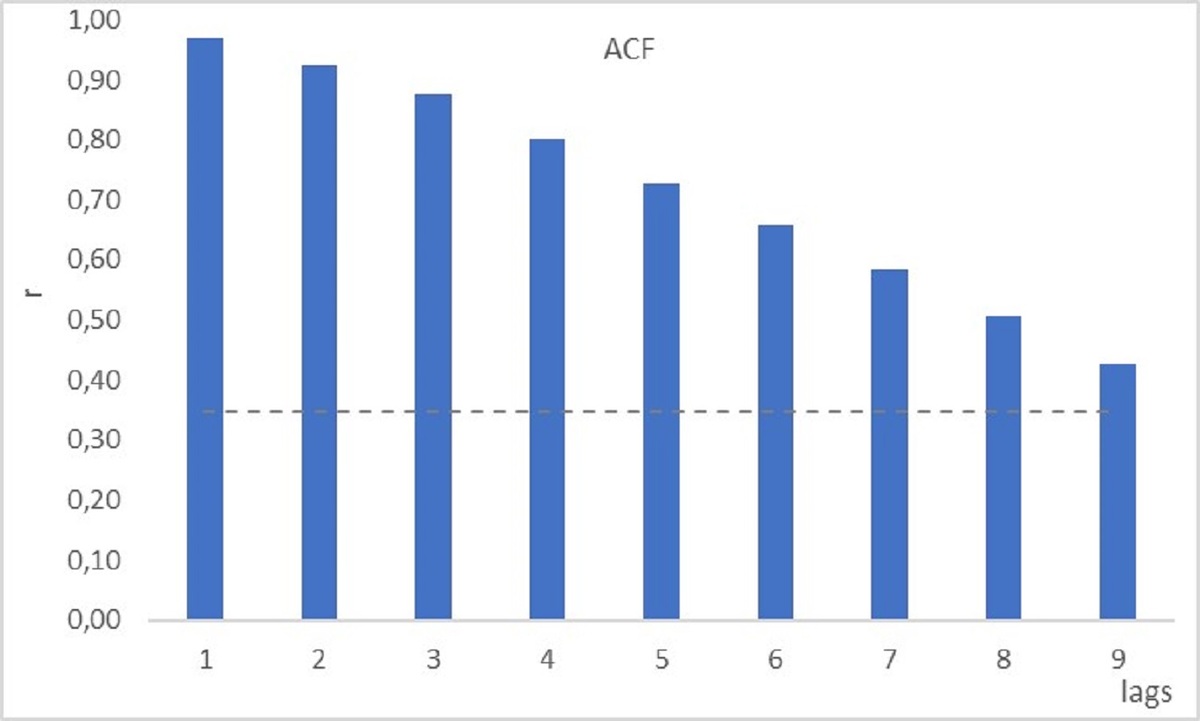

This paper employs the econometric models of relationships over time to evaluate the change in the unit prices of apartments on the local secondary markets in Warsaw and Szczecin, depending on various socioeconomic factors. Indicators reflecting the influence of socio-economic aspects in these cities and the lagged values of housing prices, acting as so-called anchors in this model, were used as the independent variables.

The results obtained from this analysis indicate that it is the lagged prices of housing that have the strongest influence on the formation of price levels in the market. The study confirms the presence of the so-called price anchoring effect, which can be understood as the tendency of market participants to accept prices at levels that can be justified not only by socio-economic factors, but also by the price levels established in their minds.

The main purpose of the research presented here is to show that there is no close relationship between quoted housing prices and their objective factors. The quality of models reflecting these relationships clearly improves when lagged housing prices are introduced as the explanatory variables, which may confirm the price anchoring effect derived from behavioral economics, meaning that the heuristics of anchoring and adjustment can be applied to the analysis of the behavior of a collective of individuals - many market participants.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.