Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

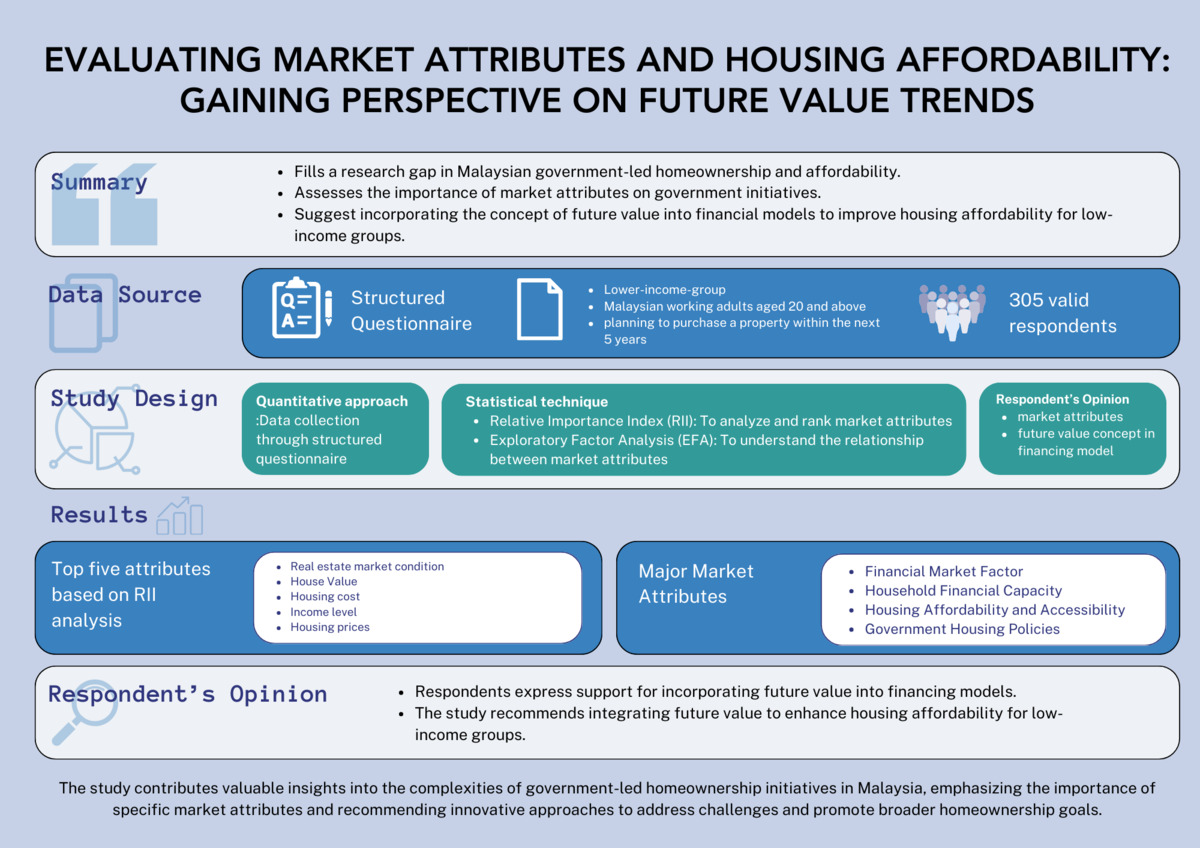

Evaluating market attributes and housing affordability: Gaining perspective on future value trends

1

Faculty of Built Environment, Universiti Malaya, Malaysia

2

College of Built Environment, Universiti Teknologi Mara, Malaysia

3

School of Construction Economics and Management, University of the Witwatersrand, South Africa

Submission date: 2023-12-05

Final revision date: 2024-04-23

Acceptance date: 2024-06-03

Publication date: 2024-09-10

REMV; 2024;32(3):87-100

HIGHLIGHTS

- market attributes like house value and economic conditions are pivotal for housing affordability

- despite the lower ranking, government housing policies are crucial in homeownership

- factor analysis underscores the significant influence of government initiatives on housing affordability

- respondents strongly favor adopting reverse mortgages and incorporating future value for heightened affordability

KEYWORDS

TOPICS

ABSTRACT

This study fills a significant research gap in Malaysian government-led homeownership and affordability. Centered on crucial market attributes influencing these initiatives, insights from low-income groups were obtained. The primary aim of this study was to assess the importance of various market attributes on government homeownership initiatives in Malaysia. The data were collected from low-income groups using a structured questionnaire, providing valuable insights into the unique challenges faced by this demographic. A Relative Importance Index (RII) was employed to analyze the data, revealing that Financial Market Factors, Household Financial Capacity, Housing Affordability and Accessibility, and Government Housing Policies were the market attributes of the highest importance in shaping government homeownership efforts. The results of the exploratory factor analysis demonstrated that the Financial Market Factor was the most influential component, as indicated by its mean rank. This study sought to incorporate the valuable perspectives of respondents regarding integrating future value into financing models. Respondents' opinions reflected a significant level of support for such innovative approaches. This study examines the crucial market attributes influencing government homeownership initiatives in Malaysia. The findings underline the potential of incorporating future value into financing models to enhance housing affordability for low-income groups and promote broader homeownership objectives.

FUNDING

The research received financial backing from the Ministry of Higher Education Malaysia under the Fundamental Research Grant Scheme (FP129-2020), demonstrating full sponsorship, with the Ministry contributing 100% of the required funding.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.