Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Forecasting the volatility of real residential property prices in Malaysia: A comparison of GARCH models

1

Department of Fundamental and Applied Science, Universiti Teknologi PETRONAS, Malaysia

2

Management Science Research Group, Faculty of Ocean Engineering Technology and Informatics, Universiti Malaysia Terengganu, Malaysia

3

Department of Informatics Engineering, Faculty of Engineering, Universitas Islam Riau, Indonesia

4

Department of Mathematics and Computer Science, Umaru Musa Yar'adua University, Nigeria.

5

Universitas Islam Indragiri, Indonesia

Submission date: 2022-09-26

Final revision date: 2022-12-09

Acceptance date: 2023-01-11

Publication date: 2023-09-07

Corresponding author

Mahmod Othman

Department of Fundamental and Applied Science, Universiti Teknologi PETRONAS, Malaysia

Department of Fundamental and Applied Science, Universiti Teknologi PETRONAS, Malaysia

REMV; 2023;31(3):20-31

HIGHLIGHTS

- the volatility of Malaysian residential property price has been studied to determine the appropriate time series forecasting method to assist investors and in decision-making

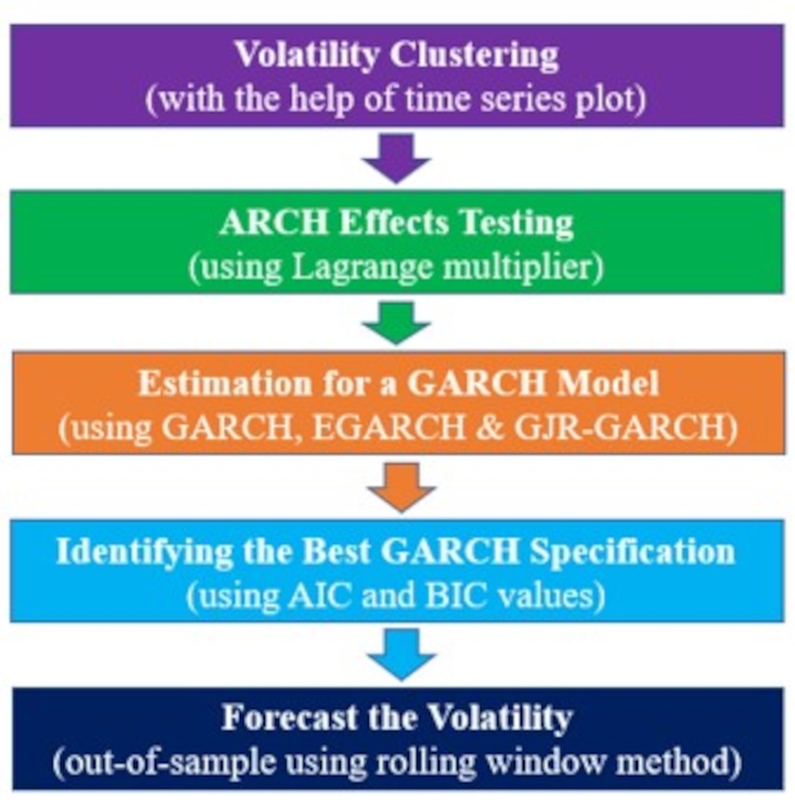

- volatility models such as the GARCH, EGARCH, and GJR-GARCH models were compared to determine the most suitable forecasting model

- the GJR-GARCH was found to be the most suitable volatility model for the residential property price dataset

KEYWORDS

TOPICS

ABSTRACT

The presence of volatility in residential property market prices helps investors generate substantial profit while also causing fear among investors since high volatility implies a high return with a high risk. In a financial time series, volatility refers to the degree to which the residential property market price increases or decreases during a particular period. The present study aims to forecast the volatility returns of real residential property prices (RRPP) in Malaysia using three different families of generalized autoregressive conditional heteroskedasticity (GARCH) models. The study compared the standard GARCH, EGARCH, and GJR-GARCH models to determine which model offers a better volatility forecasting ability. The results revealed that the GJR-GARCH (1,1) model is the most suitable to forecast the volatility of the Malaysian RRPP index based on the goodness-of-fit metric. Finally, the volatility forecast using the rolling window shows that the volatility of the quarterly index decreased in the third quarter (Q3) of 2021 and stabilized at the beginning of the first quarter (Q1) of 2023. Therefore, the best time to start investing in the purchase of real residential property in Malaysia would be the first quarter of 2023. The findings of this study can help Malaysian policymakers, developers, and investors understand the high and low volatility periods in the prices of residential properties to make better investment decisions.

ACKNOWLEDGEMENTS

The authors would like to thank the Universiti Teknologi PETRONAS for providing support to this project. The authors would like to thank the Universiti Teknologi PETRONAS for providing support to this project. The first author would also like to express his gratitude to the Universiti Teknologi PETRONAS for sponsoring his PhD studies and providing him with a position as a graduate research assistant. In addition, the authors would like to express their appreciation to the editor and reviewers whose comments greatly enhanced the quality of this paper.

FUNDING

This project was supported by Yayasan Universiti Teknologi Petronas. Research Grant: (015LC0-296).

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.