Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

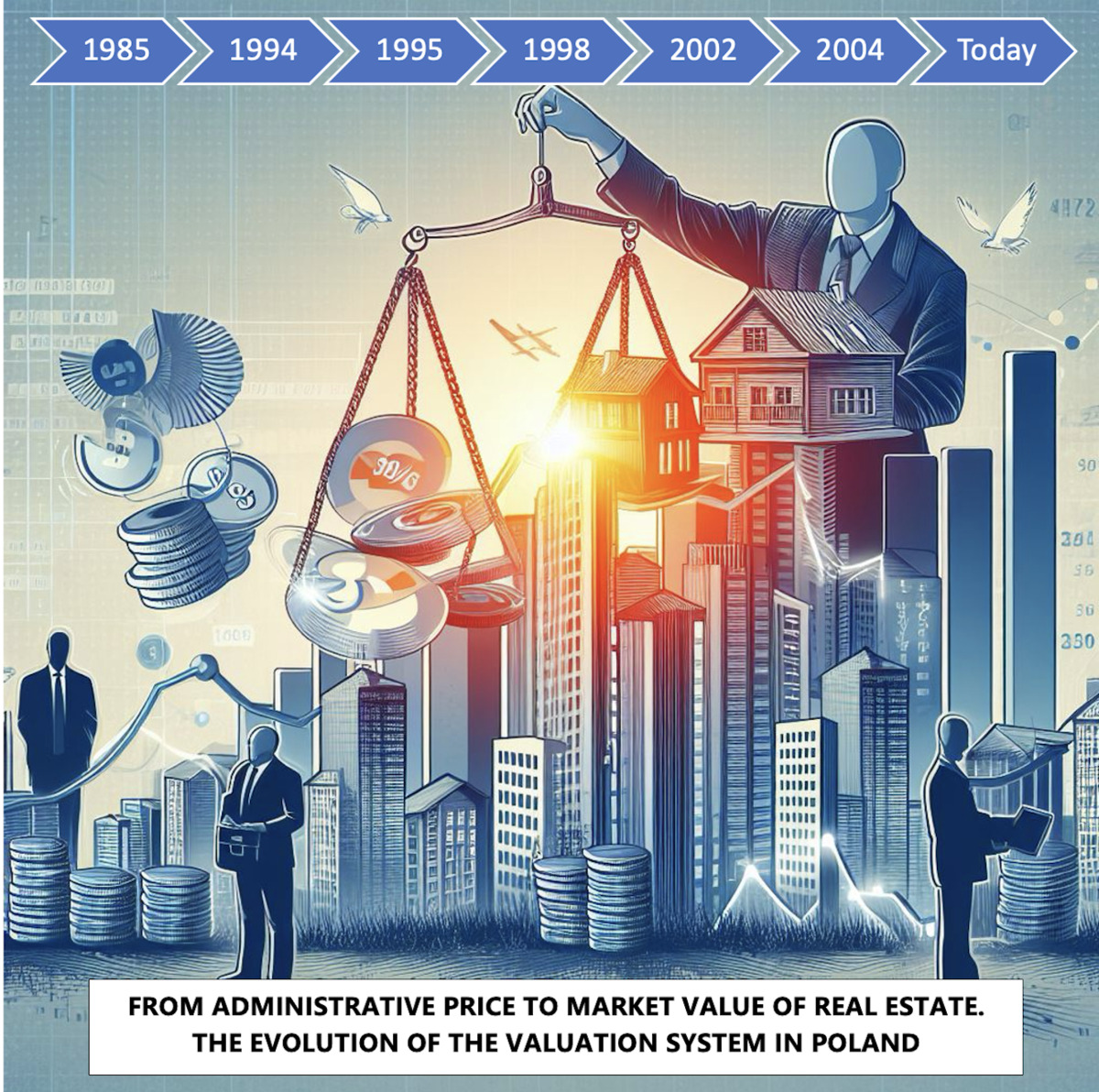

From administrative price to market value of real estate. The evolution of the valuation system in Poland

1

Faculty of Geoengineering, University of Warmia and Mazury in Olsztyn, Poland

Submission date: 2024-05-15

Final revision date: 2024-08-27

Acceptance date: 2024-09-06

Publication date: 2024-09-10

Corresponding author

REMV; 2024;32(3):127-142

HIGHLIGHTS

- socio-political factors determine the state of the real estate market

- development of science and technology inspires changes in the approach to MA and REV

- the methodology for determining value follows the diverse needs of valuation clients

KEYWORDS

TOPICS

ABSTRACT

The article applies the method of historical research, using a temporal perspective dating back to 1985, to trace the evolution of market valuation principles for real estate in Poland. These principles evolved similarly to those in many other post-socialist countries, influenced by political and socio-economic transformations and the resulting list of objectives for which these values became essential. The changing legal regulations allowing for the emergence and development of a free real estate market played a decisive role in this process. It was also a period of preparing real estate valuation professionals to meet these requirements. Today, the methodology of valuation, under increasing pressure from various real estate market entities and the rapid advancement of intelligent data collection and processing technologies, is undergoing further evolution. In many countries, including Poland, lively discussions and disputes are ongoing regarding the legal authorization of statistical tools and automated valuation models in valuation practice. These possibilities are being considered particularly in the context of mass property valuations for tax purposes. The methodology involves the analysis of Polish legal provisions, foreign literature, and documents proving the gradual marketization of valuation principles.

CONFLICT OF INTEREST

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.