Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

How to weaken the endowment effect in the housing market? The role of behavioral interventions

1

Krakow University of Economics, Department of Real Estate and Investment Economics, Poland

Submission date: 2024-04-26

Final revision date: 2024-07-10

Acceptance date: 2024-09-09

Publication date: 2024-12-22

Corresponding author

Mateusz Tomal

Krakow University of Economics, Department of Real Estate and Investment Economics, Poland

Krakow University of Economics, Department of Real Estate and Investment Economics, Poland

REMV; 2024;32(4):96-104

HIGHLIGHTS

- behavioral interventions aim to highlight and visualise relevant information

- the endowment effect exists in the Polish housing market

- the endowment effect is significantly weakened after behavioral interventions

KEYWORDS

TOPICS

C91 - Laboratory, Individual BehaviorC93 - Field ExperimentsD46 - Value TheoryR31 - Housing Supply and Markets

ABSTRACT

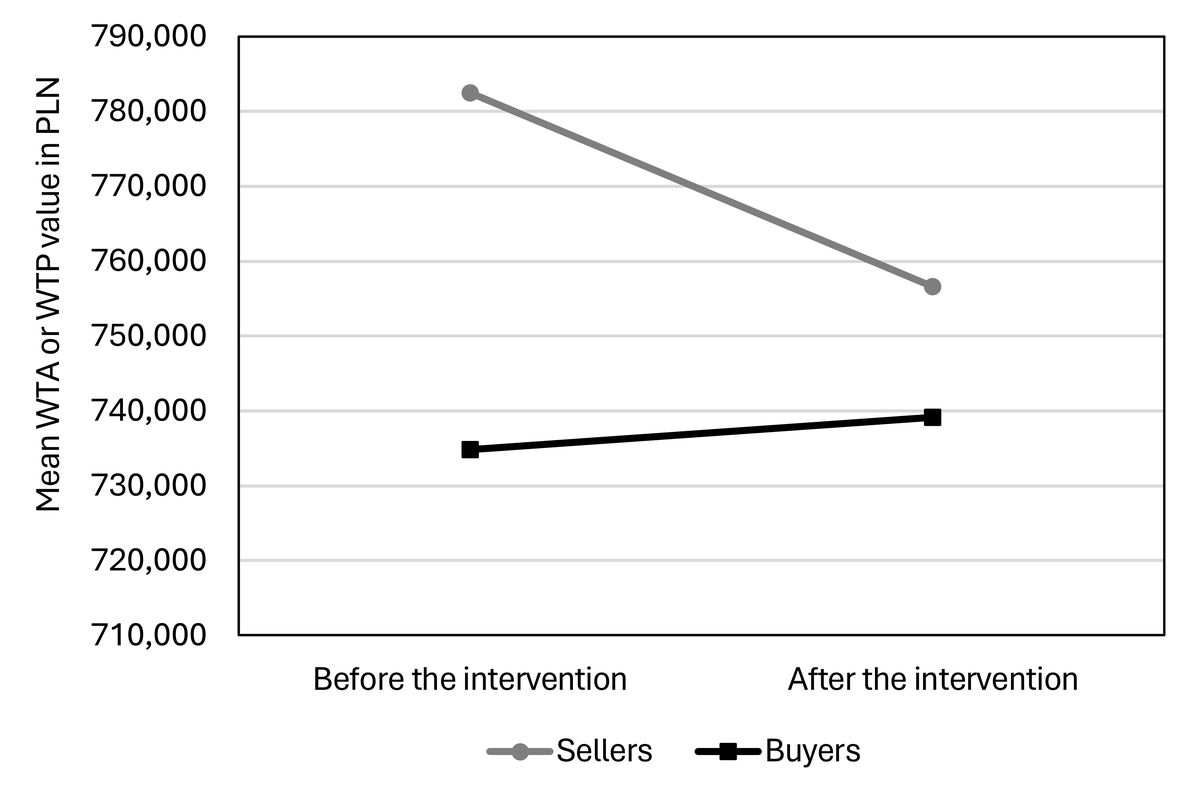

The endowment effect is one of the key behavioral biases causing friction in the housing market. It results in sellers' offer prices being inflated relative to buyers' bid prices. Although this effect has been confirmed in many studies, little is known about how it can be reduced or eliminated. Therefore, this article assesses the impact of behavioral interventions on the intensity of the endowment effect using the Polish housing market as a case study. The research was based on a lab-in-the-field experiment, in which a hypothetical transaction in the secondary sales housing market was simulated and the recruited respondents were randomly divided into sellers and buyers. The endowment effect was measured by the gap between the average value of minimum prices for which sellers would be willing to sell a dwelling (WTA) and the average value of maximum prices that buyers would be willing to pay to acquire that dwelling (WTP). The results show that the endowment effect significantly decreases but does not disappear after the application of behavioral interventions. The latter consists of highlighting relevant information about the market price of a property and visualizing it graphically. Specifically, before the intervention, the WTA-WTP gap was 7.01%, and after 2.48%.

FUNDING

The publication presents the results of the Project financed from the subsidy granted to the Krakow University of Economics.

CONFLICT OF INTEREST

The Author is a section editor of Real Estate Management and Valuation but took no part in the peer review and decision-making processes for this article.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.