Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Land and residential property taxation model. Concept of tax zoning in municipalities

1

SGH Warsaw School of Economics, Poland

2

Wrocław University of Economics and Business, Poland

Submission date: 2024-08-11

Final revision date: 2024-12-31

Acceptance date: 2025-01-16

Publication date: 2025-06-24

REMV; 2025;33(2):39-54

HIGHLIGHTS

- the current Polish real estate taxation system, is inefficient and unfair

- the concept offers an alternative to the difficult-to-implement ad valorem tax

- the article introduces a model for zoning, adaptable to local conditions

- it demonstrates its application in Olsztyn and Wrocław

- simulations suggest that tax zoning could influence municipal income

KEYWORDS

TOPICS

ABSTRACT

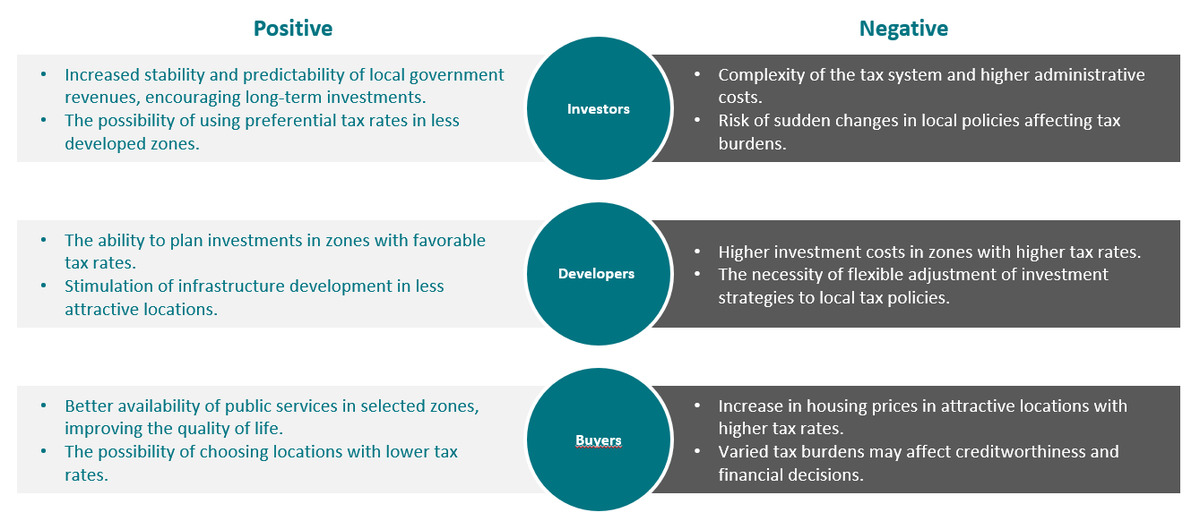

Analysis of the current property tax structure, which is calculated in proportion to the area of land and buildings, leaves no doubt that this is not an appropriate solution in terms of tax efficiency and equity. Property tax reform is necessary; however, the concept of ad valorem tax is challenging to introduce and implement. An alternative to value-based property tax could be the concept of tax zoning, particularly in heterogeneous urban areas. This would partially expand existing legal regulations, which allow for differentiating tax rates for different types of taxable items, particularly considering their location. The article presents this concept as one that could effectively replace the existing residential property taxation system in a short time. Due to the significant socio-economic diversity of urban units, it is necessary to identify factors reflecting their specificity. The article attempts to quantify the criteria considered significant for residents of Polish cities. A combination of various measures allowed for the indication of the potential effects, both fiscal and non-fiscal. The proposed concepts were validated through empirical analysis based on data from publicly accessible databases. The research results emphasize the importance of the precise design of the property tax system, which can have significant consequences for the dynamics of the real estate market.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.