Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Lessons from the US and German REIT Markets for Drafting a Polish REIT Act

1

Uniwersytet Gdański, Faculty of Management

2

RheinMain University, Faculty of Architecture and Civil Engineering

Submission date: 2021-05-22

Final revision date: 2021-07-15

Acceptance date: 2021-07-25

Publication date: 2022-03-17

REMV; 2022;30(1):1-12

HIGHLIGHTS

- aspects stimulating and inhibiting the development of the REIT market

- potential development of REIT market in Poland

- the experiences and comparison of the American and German REIT markets

- the recommendation of certain changes to the presented draft of the PL-REIT Act

KEYWORDS

TOPICS

L85 - Real Estate ServicesR39 - Real Estate Markets, Spatial Production Analysis, and Firm Location: Other

ABSTRACT

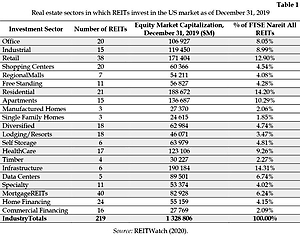

Investors are increasingly allocating capital into the real estate market through indirect investment vehicles such as REITs. There are currently no classic REITs in Poland, but given the experience of other countries and the expectations of Polish investors, an act is being prepared to regulate their functioning. The introduction of legal regulations regarding REITs has not always resulted in successful proliferation of these vehicles in each country. The German market for G-REITs is such an example, were only six G-REITs have evolved. There is also the example of the market in the United States, where extremely dynamic development of such institutions has been observed, especially in the recent years. At the end of 2019, 219 institutions of this type were operating on the US market. The purpose of this article is to identify, based on the experiences of the American and German markets, aspects stimulating and inhibiting the development of the REIT market, and then, on their basis, to recommend certain regulations, which might have been included in the PL-REIT act, and which were not included in first draft of the act in 2018. Taking them into account could cause the Polish act to stimulate the development of REITs in Poland to a greater extent.

Share

RELATED ARTICLE