Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Editor's Choice

Low interest rates and uncreative destruction in the office market

1

Warsaw School of Economics, Narodowy Bank Polski, Poland

2

Uniwersytet Gdański, Poland

Submission date: 2023-09-25

Final revision date: 2024-01-24

Acceptance date: 2024-02-13

Publication date: 2024-06-10

REMV; 2024;32(2):90-99

HIGHLIGHTS

- we investigate uncreative destruction in the office market in Poland

- we explain this phenomenon with the Cobb-Douglas production function and an accounting model

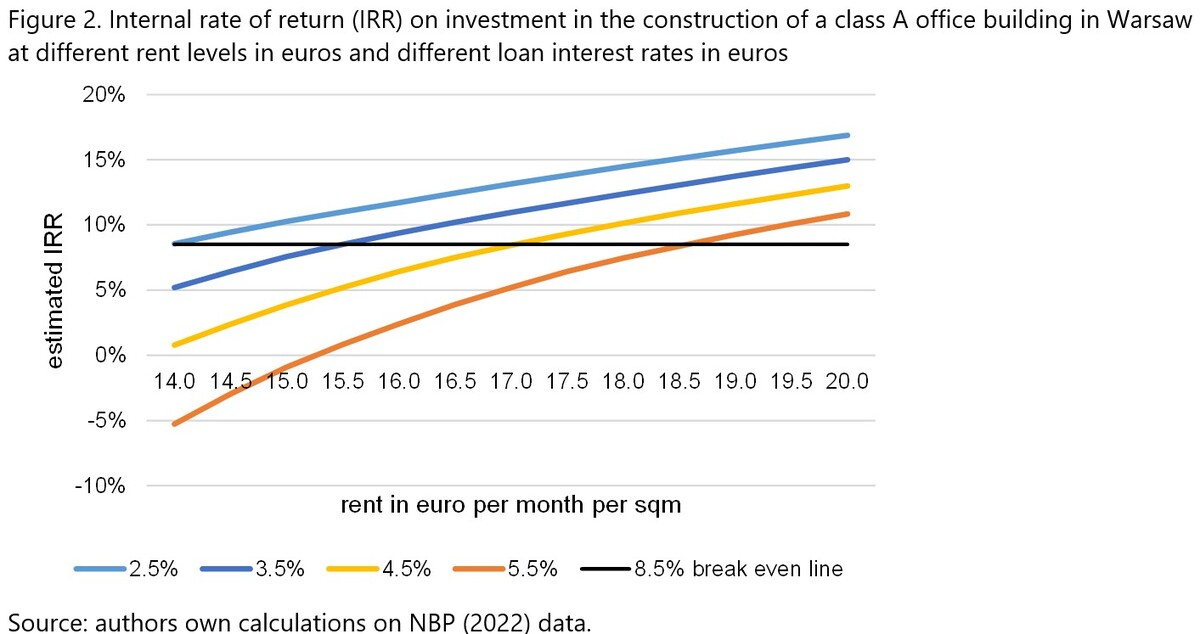

- low interest rates make financial costs low and allow market entrants to lower rents

- lower rents allow to fight for tenants

- high competiton increases the depreciation of older buildings

KEYWORDS

TOPICS

ABSTRACT

Low interest rates were introduced in the global economy to support the weak economic growth that followed the global financial crisis. However, in the real estate sector, low interest rates usually lead to a boom in investment and prices. However, this boom is not spread throughout the economy, but rather concentrated in major cities. We demonstrate this phenomenon with the example of the office market in Warsaw (Poland). While it would be beneficial for the Polish economy to develop office space in smaller cities that have an insufficient supply of modern office space, investors have focused mainly on the capital. This has not only led to an increase in the cost of building land and construction, but has also pushed some relatively new existing office buildings out of the market. We call such behaviour uncreative destruction and explain why it was possible.

ACKNOWLEDGEMENTS

We would like to thank prof. Iwona Foryś for a discussion about the paper during the XXX Polish Real Estate Scientific Society Conference in 2023. We also would like to thank the Editor and two anonymous Reviewers for valuable comments, especially those concerning the importance of ESG (Environmental, Social and Governance) and remote work in regards to the demand and supply of office space.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.