Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

Perceived risk & Intention to invest through online real-estate sites

1

Department of Management Sciences, COMSATS University Islamabad, Pakistan

2

COMSATS University Islamabad, Pakistan. School of Business Sciences, University of Witwatersrand, South Africa

3

Shifa Tameer-E-Millat University Islamabad & COMSATS University, Islamabad, Pakistan

4

Faculty of Management, University of Warsaw, Poland

5

Finance Department, College of Business, King Abdulaziz University, Rabigh, Saudi Arabia

Submission date: 2024-04-25

Final revision date: 2024-12-29

Acceptance date: 2025-01-24

Corresponding author

Majed Alharthi

Finance Department, College of Business, King Abdulaziz University, Rabigh, Saudi Arabia

Finance Department, College of Business, King Abdulaziz University, Rabigh, Saudi Arabia

HIGHLIGHTS

- the study analyze the real estate in Pakistan

- this study examine the Perceived Risk and Intention

- the finding suggest that Investing attitude and brand equity

KEYWORDS

TOPICS

ABSTRACT

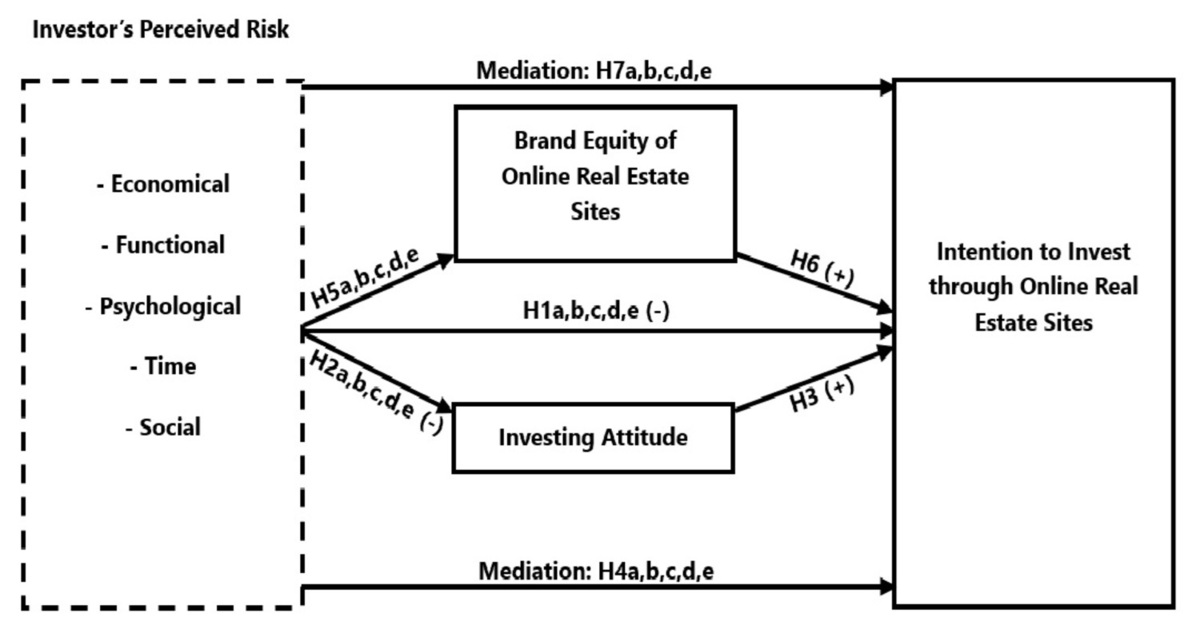

The research aims to identify how perceived risk tends to affect the intention to invest through online real estate sites. It also tends to identify the mediating role of investing attitude of the investors and their brand equity related to those sites. Survey approach was used to gather and compile all the data, and hypotheses were tested through the structural equation modeling technique. The outcomes revealed a negative role played by economic, functional, time and social risk on the intention of investors to invest through online real estate sites. The five different kinds of perceived risk showed a negative influence on investing attitude and brand equity except for social risk which positively influenced brand equity and investing attitude. Investing attitude and brand equity cause a positive change in investors’ intentions to invest. In addition to it, investing attitude and brand equity of online real estate sites significantly mediates the linkage between all types of perceived risk and investors’ investment intentions. Online real estate sites can use this model to determine how different investors perceive risk related to real estate sites and in turn work on these factors to increase their intentions for investment which ultimately is the primary basis of actual investment. There have not been many studies related to investment through online real estate sites. Especially in Pakistan, no such study that involved the investors’ intentions to invest through online real estate sites had been conducted earlier. Brand Equity of online real estate sites is also a variable which has been studied for the first time in this work with intentions to invest. Thus, this study presents the first confirmation of this model within the online real estate industry.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.