Current issue

Online first

Archive

About the Journal

Aims and scope

Editorial Board

International Editorial Board

List of Reviewers

Abstracting and indexing

Ethical standards and procedures

REMV in Social Media

Contact

Instructions for Authors

Instructions for Authors

Manuscript formatting template

Title page

Highlights

Payments

‘Ghostwriting’ and ‘Guestauthorship’

Guidelines for Referees

The impact of the flight to quality on office rents and vacancy rates in Tokyo

1

Graduate School of Systems and Information Engineering, University of Tsukuba, Japan

2

Sanko Estate Co., Ltd.

Submission date: 2023-12-07

Final revision date: 2024-03-27

Acceptance date: 2024-04-24

Publication date: 2024-09-10

Corresponding author

REMV; 2024;32(3):77-86

HIGHLIGHTS

- "flight-to-quality" phenomenon threatens to polarize the office real estate market

- in the flight to quality, companies prefer office buildings with "modern amenities" for their employees

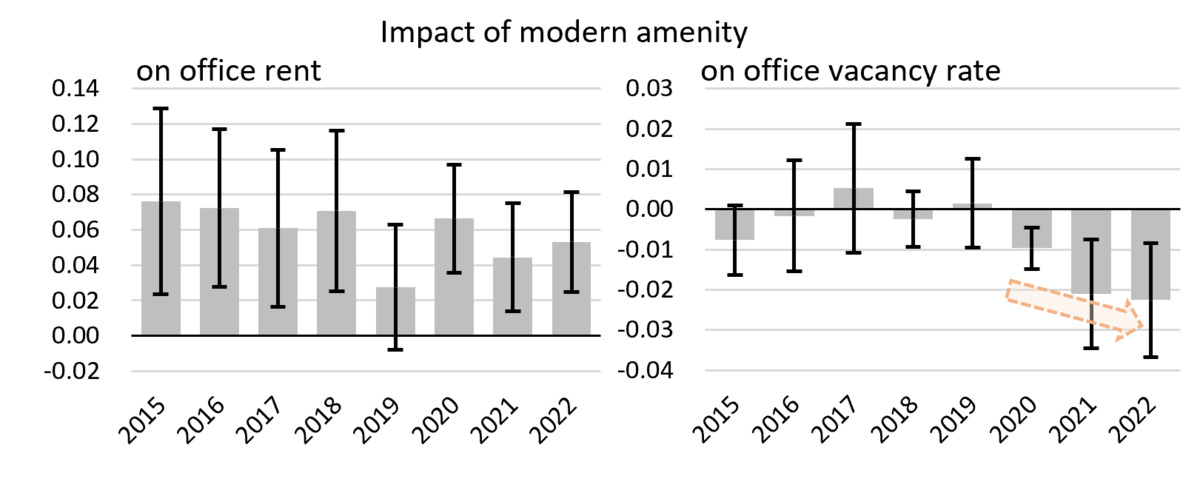

- buildings with modern amenities command higher rents and lower vacancy rates

- significance of these amenities diminishes for properties less competitive in age, size, and location

KEYWORDS

TOPICS

ABSTRACT

With the rapid spread of telecommuting since the COVID-19 pandemic, companies have been relocating to high-end business centers, thereby enhancing the workplace experience for employees, a phenomenon called the "flight to quality." However, this trend’s impact on rents and vacancy rates in individual office buildings has not been extensively studied. To determine the effects of the flight-to-quality phenomenon on individual buildings, we examine the impact of modern amenities, which directly influence employee lifestyles, on rents and vacancy rates in the Tokyo office market. Using a propensity score-based quasi-experimental method, we find that commercial properties with such modern amenities command higher rents and experience lower vacancy rates than those without. The difference in vacancy rates has increased since 2020. However, the significance of these amenities diminishes for properties less competitive in age, size, and location. The results indicate that the "flight to quality" may further polarize the office real estate market into two categories: one for high-end buildings experiencing increasing demand, and another for those with modest amenities experiencing decreasing demand. The findings have implications for office building owners/investors and the government, make educated decisions as to whether to invest in modern amenities, join the quality competition, or encourage urban restructuring.

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.